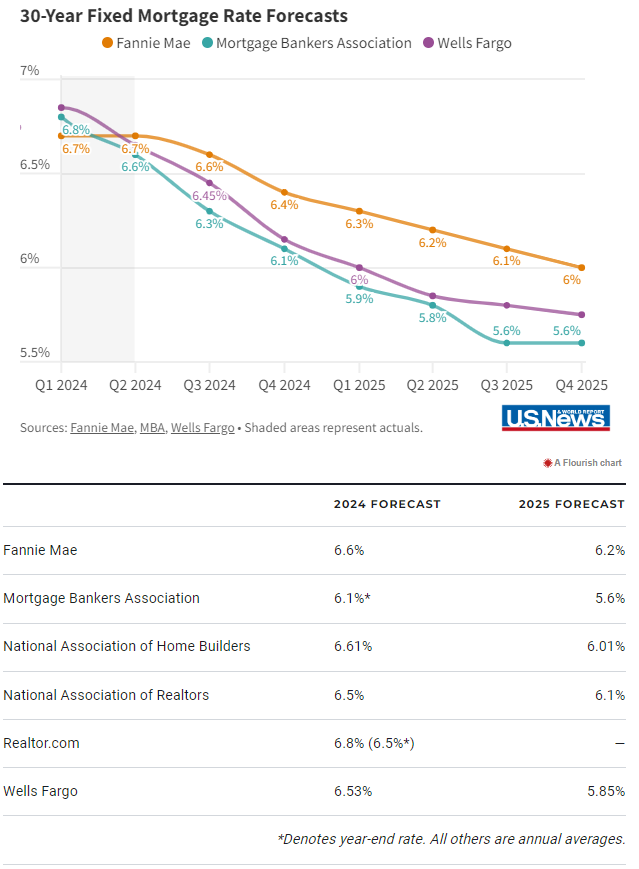

Later in the year, as the US economy contracts, inflation decreases, and interest rates are lowered by the Federal Reserve, mortgage rates are predicted to drop. By the end of 2024, the 30-year fixed mortgage rate is predicted to drop to the mid- to low-6% level; by early 2025, it may even reach the high-5% area.

Here are the predicted movements in mortgage interest rates for the remainder of the year and the resulting effects on the housing market overall.

Aprill 2024 Mortgage Rate Forecast

When Do Mortgage Interest Rates Drop?

When the Federal Open Market Committee lowers the benchmark interest rate, which is anticipated to occur in the second half of 2024, mortgage rates are predicted to decrease. But rates will stay high at their current levels as long as inflation continues to run higher than the Fed would prefer.

The chief economist at Freddie Mac, Sam Khater, stated in a statement on February 22 that “strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates.”

While most economists concur that interest rates should gradually decline each quarter, many disagree on the ultimate extent of the decline: Some predict that by year’s end, rates will drop to about 6%, while others predict that they will remain high in the mid-6% area. Here are the opinions of specialists regarding their forecasts for this year.

Fannie Mae: Interest Rates Will Drop to 6.4%

According to Fannie Mae’s March Housing Forecast, the average 30-year fixed rate will be 6.7% in the first quarter of 2024 and 6.4% at the end of the year. Fannie Maestro, the mortgage giant, had predicted just a month ago that rates would fall below 6% by the end of the year. This represents an upward modification to their study. In total, mortgage rates are expected to average 6.6% in 2024 and 6.2% in 2025, according to Fannie Mae.

Doug Duncan, senior vice president and chief economist at Fannie Mae, stated in a statement on March 19 that “hotter-than-expected inflation data and strong payroll numbers are likely to apply more upward pressure to mortgage rates this year than we’d previously forecast, as markets continue to evolve their expectations of future monetary policy.”

• MBA: Rates Will Decline to 6.1%

In its March Mortgage Finance Forecast, the Mortgage Bankers Association predicts that mortgage rates will fall from 6.8% in the first quarter of 2024 to 6.1% by the fourth quarter. The industry group expects rates will fall below the 6% threshold in the first quarter of 2025.

“The strength in the job market, along with an economy that is still growing at a moderate pace, are positives for the housing market, as it supports home purchase activity and helps borrowers to stay current on their mortgage payments,” MBA economists say in a March 2024 outlook. “However, the labor market’s continued resiliency is one of several factors keeping mortgage rates from declining much further in the near term, as it increases the likelihood that the Fed will not rush to cut rates.”

• NAR: Rates Will Decline to 6.1%

The National Association of Realtors expects mortgage rates will average 6.8% in the first quarter of 2024, dropping to 6.6% in the second quarter, according to its latest Quarterly U.S. Economic Forecast. The trade association predicts that rates will continue to fall to 6.1% by the end of the year.

“The latest [CPI] data does not fundamentally change what the Fed will likely do – three rate cuts this year,” says Lawrence Yun, NAR’s chief economist, in a March 13 statement. “However, with anticipated further easing in inflation, especially as rents in the official measurement are showing calming patterns, five to eight rounds of rate cuts by the end of next year will help lower mortgage rates.”

• Realtor.com: Rates Will Decline to 6.5%

The real estate listings website Realtor.com predicts in a 2024 Housing Market Forecast that rates will average 6.8% this year, dipping to 6.5% by the end of 2024.

“Although mortgage rates are expected to begin to ease, they are expected to exceed 6.5% for the calendar year,” the report reads. “This means that the lock-in effect, in which the gap between market mortgage rates and the mortgage rates existing homeowners enjoy on their outstanding mortgage, will remain a factor.”

• Wells Fargo: Rates Will Decline to 6.15%

In its latest U.S. Economic Outlook, the Economics Group of Wells Fargo Bank puts the 30-year conventional mortgage rate at 6.85% in the first quarter of 2024, declining to 6.15% by the end of the year. Wells Fargo economists predict that the average rate will dip below 6% in the second quarter of 2025.

“We expect disinflation progress to resume in the coming months, but we think the FOMC will need to see it to believe it,” Wells Fargo researchers say in a March forecast update. “The first rate cut looks increasingly likely to occur in June.”

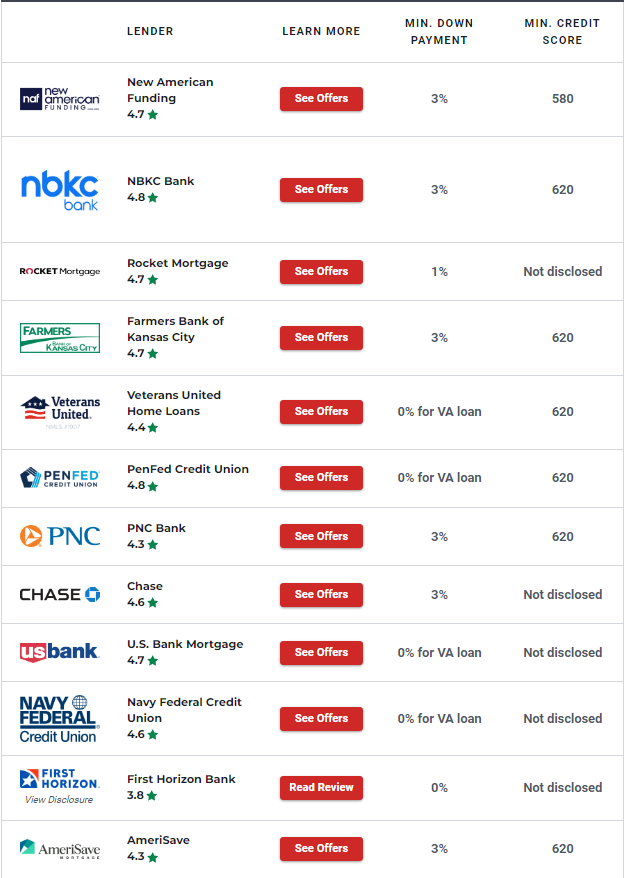

Compare Top Mortgage Lenders

Stubbornly high mortgage rates in 2023 were a byproduct of the Fed’s battle to tame inflation to its 2% annual target amid positive economic growth, despite the pressures of rising interest rates. The central bank raised the federal funds rate seven times in 2022 and another four times in 2023, with the latest 25-basis-point rate hike coming at its July meeting.

During the Fed’s March rate-setting meeting, policymakers voted again to hold the target range steady at 5.25% to 5.5%, and it appears the central bank has finished its tightening cycle, Fed Chair Powell said at a March 20 news conference.

The Fed’s latest projections materials show that three rate cuts are still expected in 2024, bringing the rate down by three-quarters of a percentage point by the end of the year. However, the Fed’s economic policy isn’t set in stone. If the economy begins to show signs of heating up, policymakers may adjust their path accordingly.

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year,” Powell says. “The economic outlook is uncertain, however, and we remain highly attentive to inflation risks. We are prepared to maintain the current target range for the federal funds rate for longer, if appropriate.”

But given the Fed’s projections and recent commentary, multiple rate cuts in 2024 seem more likely than not. Investors are expecting that rate cuts will begin in June, according to CME Group’s FedWatch Tool. Economists at Freddie Mac, the MBA and Wells Fargo also predict that the FOMC will cut rates in June at the earliest.

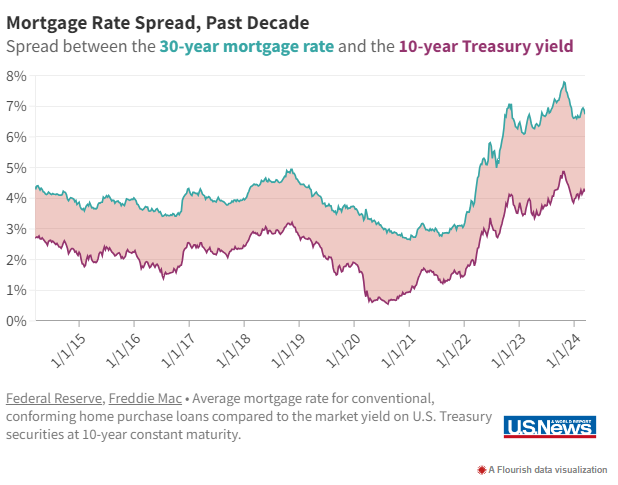

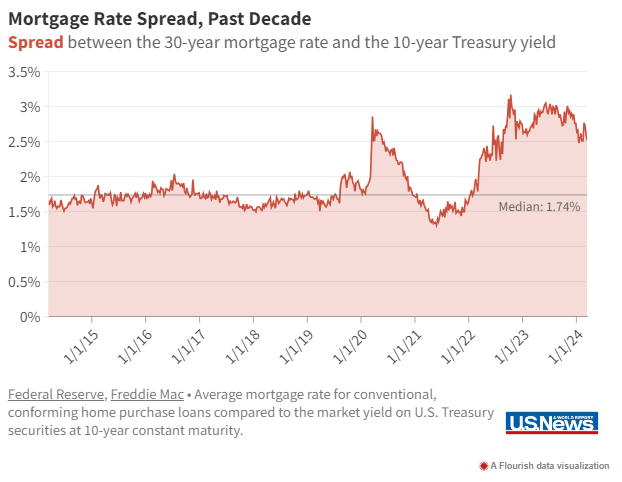

Another reason why mortgage rates are expected to fall is the abnormally large spread between the 30-year fixed mortgage rate and the yield on 10-year Treasury bonds. That spread is historically around 170 basis points, but it was closer to 300 basis points throughout most of 2023.

Treasury yields have moderated over the past few months, and if spreads were to return to “normal,” mortgage rates would be under 6%. The spread probably won’t fall to 170 points anytime soon, but it is expected to retreat somewhat this year, which will help bring mortgage rates to the low-6% range.

“Mortgage-Treasury spreads have narrowed with recent levels near 250 basis points, still wide relative to historical averages but much better than the 300 basis points experienced last year,” MBA economists say. “We expect the spread will tighten further by the end of 2024.”

How Current Mortgage Rates Impact the Housing Market

Advice for Buying or Selling a Home in 2024

Mortgage rates are expected to decline this year, which has implications for prospective homebuyers and sellers. But regardless of current mortgage rate trends, Americans will still have a motivation to move, whether they want to downsize in retirement or need to relocate for a better job.

Here’s what you should consider if you’re planning on buying or selling a home in 2024.

What Buyers Should Know: Waiting for Rates to Fall Comes With Its Downsides

Good things may come to those who wait, but patience doesn’t always pay off in the housing market. Two-thirds of homebuyers are waiting for mortgage rates to fall this year before buying a home, according to a March U.S. News survey. However, 67% of 2024 buyers put off purchasing a home in 2023 because they were holding out for lower rates – which didn’t come.

In fact, rates trended higher last year, reaching a new peak of 7.79% in late October, according to Freddie Mac, before plunging a full percentage point to around 6.6% by year-end. And in the first quarter of 2024, rates started rising amid unexpected economic strength, hovering around the 7% mark once again.

In the time that homebuyers have been holding out for lower rates, home prices have continued to rise. On a national basis, home prices increased 6% between January 2023 and January 2024, according to the S&P CoreLogic Case-Shiller Home Price Index. Home prices are expected to stabilize this year – but buyers shouldn’t expect them to come crashing down, at least not on a national level.

Here are a few 2024 home price forecasts from top U.S. housing economists:

CoreLogic: Home prices will rise 3.2% in 2024.

Fannie Mae: Home prices will rise 3.2% in 2024 and 0.3% in 2025.

Freddie Mac: Home prices will rise 2.5% in 2024 and 2.1% in 2025.

NAR: Home prices will rise 0.9% in 2024 to $389,500.

Zillow: Home prices will be steady this year, decreasing by -0.2%.

Although home prices aren’t likely to drop significantly, it’s still positive that they’re not likely to keep rising at the double-digit pace seen in 2021 and 2022. Without over-the-top bidding wars to drive home values through the roof, buyers can expect more properties to choose from.

That’s not to say it will be a buyer’s market, but there should at least be some more balance between buyers and sellers. Buyers may be able to close the deal without having to waive important protections like home inspection and appraisal contingencies. What’s more, existing home inventory is forecast to improve (at least marginally) as rates drift lower and some previously rate-locked homeowners decide to sell.

Additionally, buyers may find less competition in the new home construction market. Homeowners may be reluctant to sell and sacrifice their low mortgage rates, but homebuilders remain eager to close the deal. Although new-construction homes are typically more expensive than resale homes, builders may be willing to offer other concessions like price reductions or temporary interest-rate buydowns.

What Sellers Should Know: Remember That You’re a Buyer, Too

Perhaps the biggest hurdle facing sellers is that they still need a place to live once they’ve sold their current home. For many, that means buying a new home at today’s rates and home prices. A June 2023 Redfin study found that 92% of homeowners with a mortgage have a rate below 6%, and nearly a quarter (24%) have a rate below 3%.

“Some (homeowners) simply don’t want to take on a 6%-plus mortgage rate, and some can’t afford to,” Taylor Marr, Redfin’s deputy chief economist, says in the report.

Although many prospective sellers would be hard-pressed to give up their sub-3% mortgage rate, Zillow predicts that the rate lock-in effect will wear off somewhat this year as some homeowners grow tired of waiting to move.

Plus, a recent Fannie Mae survey suggests that low rates aren’t the only factor keeping people from selling. While a fifth of mortgage borrowers (21%) say that their low mortgage rate is causing them to stay in their home for longer, nearly as many said they simply like their current home (19%). Perhaps unsurprisingly, 13% say they’re staying put because home prices are too high to buy another home.

However, there is a silver lining for sellers who are also buyers: Most homeowners who have been at their current home for at least a few years are sitting on a mountain of equity thanks to double-digit home price appreciation during that time. With a successful sale, homeowners can tap into that equity to put toward their next home purchase.

What This Means for Mortgage Refinancing Rates

The forecast for mortgage refinance rates is pretty much the same as the forecast for mortgage purchase rates: They’re likely to decline this year, but they won’t return to pandemic-era lows anytime soon. Since most homeowners have a lower rate than what’s currently available, it doesn’t really make sense to try to refinance to a lower rate right now.

The exception would be recent homebuyers who borrowed when mortgage rates were high in 2023. The vast majority (84%) of Americans who bought a home in the past year plan on refinancing to a lower rate in the future, according to a September U.S. News survey. Most of them plan on waiting until rates drop below 6%, which could feasibly happen by the end of 2024; about a fifth (19%) will wait until rates fall below 5%, and that might not happen within the next three years.

Still, it’s possible to refinance if your goal isn’t just to get a lower rate. With rate-and-term refinancing, you can switch to a shorter repayment period, like a 15-year mortgage. Doing so can help you pay off your mortgage faster and save money in the long run, since you’ll be making fewer interest payments to the lender. Of course, if your new rate is much higher, it may not be worthwhile in the long term, and your monthly payments may be significantly more expensive in the short term.

Others may want to refinance as a way to switch from an adjustable-rate mortgage, or ARM, to a fixed-rate mortgage. Refinancing to a fixed rate can help shield you from higher monthly payments when the rate adjusts, which can make it easier to budget for your housing costs. However, fixed rates are generally higher than adjustable rates, so it may be difficult to justify a refinance unless your ARM rate is slated to increase meaningfully.

Additionally, some homeowners may want to refinance to access their home’s equity. A cash-out refinance is when you borrow a mortgage that’s larger than what you currently owe, allowing you to pocket your home’s equity in cash. This might be possible if your home’s value has risen dramatically or you’ve paid down your mortgage significantly over the past few years. But keep in mind that you’ll be taking on a larger loan amount and more debt, paying more money toward interest over time. Plus, you’ll still be stuck with a higher rate.